There’s no shortage of finance blogs online—yet very few make serious money. The secret isn’t just traffic. It’s strategic monetization. And affiliate links, when used right, are the hidden infrastructure behind many high-revenue finance blogs that look ordinary from the outside.

So how exactly do you monetize a finance blog using financial affiliate links without turning it into a link farm or damaging your credibility? The answer is nuanced, methodical, and more technical than most creators realize.

What Does It Mean To Monetize A Finance Blog?

To monetize a finance blog means turning its content, traffic, and authority into predictable income through targeted, revenue-generating mechanisms such as financial affiliate links. This doesn’t imply cluttering posts with random offers or passive banner ads. Instead, it refers to aligning editorial strategy with high-intent financial product recommendations that generate commission through user actions.

In the finance niche, monetization via affiliates requires domain-specific precision. Unlike lifestyle blogs where a broad product mention can suffice, finance audiences demand substantiated claims, regulatory awareness, and functional relevance. A finance blog only converts when the monetization path mirrors the reader’s intent and the content supports a trust-based decision journey. The affiliate angle is not bolted on post-creation—it’s architected from the topic selection phase.

How Do Affiliate Links Work In The Finance Niche?

Affiliate links in finance work by tracking referrals from your blog to a financial product provider’s site and attributing qualified actions—such as sign-ups, deposits, or purchases—to your content. What separates this from other niches is the payout logic. Finance operates on higher-value transactions, stricter compliance, and extended lead validation periods. Unlike impulse-based affiliate verticals, financial platforms often have KYC, multi-step onboarding, and hold periods before conversion.

For example, when a user clicks on a credit card recommendation and applies successfully, the affiliate partner may only pay after account activation and sometimes after usage thresholds. The financial niche deals with recurring commissions finance affiliates if structured as such, which means a user’s lifetime value becomes a key profitability variable. Understanding payment models—CPL, CPA, RevShare—is essential to navigating affiliate marketing for finance bloggers with consistent ROI.

Types Of Financial Products Suitable For Affiliate Marketing

Some financial products are far more suitable for affiliate marketing than others. This depends on user demand, commission structures, and integration ease into content.

Common high-converting financial affiliate categories include:

- Banking Products: Savings accounts, high-yield checking accounts, and online banking platforms offering no-fee services.

- Investment Platforms: Robo-advisors, cryptocurrency exchanges, and stock trading apps that support affiliate referral programs.

- Credit and Loans: Credit card applications, personal loans, mortgage tools, and refinancing services—often with tiered commission systems.

- Insurance Services: Car, life, and travel insurance platforms offering fixed payouts or recurring referral income.

The suitability of each product also depends on your audience’s financial maturity and interests.

How To Choose Affiliate Programs For Finance Blogs

Selecting the best affiliate programs for finance blogs requires evaluating both the fit for your audience and the trustworthiness of the offer. Not all high-payout programs are worth integrating.

When choosing a finance affiliate program, consider:

- Cookie Duration & Attribution Windows: Look for longer cookie windows (30+ days) to account for delayed financial decisions.

- Commission Type & Structure: CPA (Cost Per Action), CPL (Cost Per Lead), or Recurring Models. Opt for recurring payouts where possible.

- Reputation & Product Transparency: Only promote products with publicly visible terms, transparent pricing, and verifiable company profiles.

- Conversion Readiness: How easy is it for your readers to take the required action? Long or complex applications lower your earnings potential.

Where To Place Affiliate Links In Financial Blog Posts

Knowing how to insert affiliate links in blog posts means understanding link visibility, user behavior, and context saturation. Financial readers typically scroll with intent, scanning for specific data points or comparisons. Burying links in dense copy reduces CTR and affects monetization. However, overly aggressive placements can erode trust and trigger bounce.

The most effective placements appear mid-article, directly following problem-solution explanations, or embedded within visual structures like tables or inline CTAs. Links embedded within anchor phrases that replicate search queries—such as “best Roth IRA for freelancers”—consistently outperform generic calls to action. Sidebar placements and footers, while lower impact, can still drive conversions from returning users who already trust your site.

Examples Of High-Converting Finance Blog Structures

High-converting finance blog structures follow a modular architecture where every content section serves a monetization, SEO, or trust function. One proven structure begins with a high-intent headline (e.g., “Best Budgeting Apps for Couples”), followed by a short context setup, detailed comparisons, FAQs, and strategically placed call to action finance content linking to affiliate offers.

Another reliable structure integrates product explanation with problem-solving. For instance, in an article about managing irregular income, an embedded section comparing budgeting tools with affiliate links introduces monetization without disrupting the flow. Posts with interactive tools—such as calculators or decision trees—also create natural insertion points and increase dwell time, which positively affects affiliate SEO finance niche visibility.

How To Write Affiliate-Friendly Financial Content

Affiliate-friendly financial content is not about keyword stuffing or product glorification. It involves structuring posts to meet informational needs while guiding the user toward a logical next step that involves an affiliate link. Trust-centric writing—rooted in clarity, factual backing, and simplicity—often drives the most sustainable revenue.

This style avoids exaggerated claims or performance promises. Instead, content frames decisions through practical lenses. For example, rather than promoting a brokerage for its bonus, it would compare fee structures, available instruments, and mobile experience, letting the reader conclude value independently. Such framing reduces link fatigue and boosts affiliate conversion optimization.

Using Comparison Tables In Finance Blog Monetization

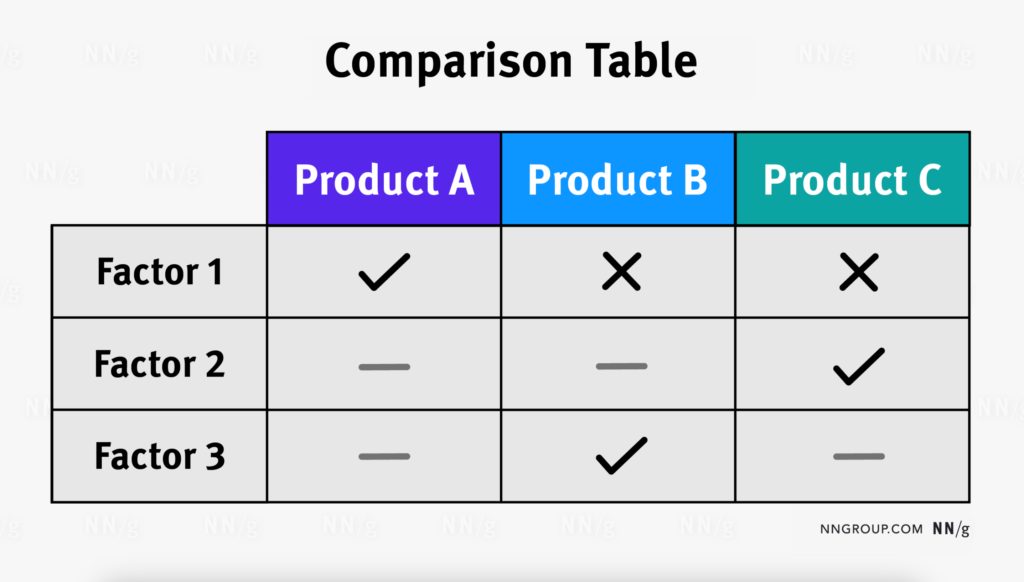

Comparison tables for affiliate links perform well when designed for skimmers who seek visual clarity before making decisions. Tables work best in mid-to-late content sections, where readers have been primed with context and are ready to evaluate. Including sorting filters or tag-based highlights (e.g., “Best for Freelancers”) boosts relevance.

However, tables must avoid being generic matrices. The value lies in specificity: highlight features that match actual decision criteria such as account minimums, withdrawal fees, or integration with tax tools. Overly stylized designs that mimic ads often underperform, especially on mobile. Effective tables are responsive, fast-loading, and anchor-linked from navigation menus.

SEO Tips For Affiliate-Driven Finance Blog Posts

Affiliate SEO in the finance niche is driven by precision, not volume. High-conversion keywords often have low search volumes but signal high intent—like “budgeting software for expats.” Optimizing for such queries requires detailed content targeting one specific use case per page.

On-page SEO should prioritize schema integration, short permalinks with keyword alignment, and FAQ sections using actual user queries. Avoid aggregating too many product links per post; this dilutes SEO and overwhelms readers. Internal linking from non-monetized educational pages to affiliate content also strengthens authority without creating spam-like structures.

How To Track Affiliate Performance On Your Finance Blog

Tracking affiliate performance on a finance blog involves using UTM parameters to separate traffic sources and understanding the logic of affiliate dashboards. Most affiliate platforms offer generic insights, but advanced tracking needs come from combining data in tools like Google Looker Studio or integrating APIs for real-time funnel analytics.

Implementing postback URLs or webhook-driven event tracking allows affiliate conversion mapping without relying on third-party cookies. For instance, if a user signs up for a loan but completes the process after days of email nurturing, tracking delayed conversion becomes vital to accurate ROI attribution. Avoid over-reliance on last-click models—they often misrepresent your finance blog earning strategies.

What Is The Best Content Format For Finance Affiliate Links?

The best content format for finance affiliate links depends on the intent stage of the reader. Mid-funnel comparison articles and bottom-funnel tool reviews generally produce the highest EPCs. Long-form evergreen content that answers specific questions while embedding affiliate solutions outperforms clickbait or news-based formats.

Podcasts and video content, while engaging, often underperform in raw conversion unless tied with strong CTA frameworks. Conversely, written guides that include visual embeds and structured takeaways allow affiliate links to feel like a natural extension of the content rather than promotional interruptions.

How To Maintain Trust While Using Affiliate Links In Finance

Maintaining trust while using affiliate links in finance involves transparent disclosures, consistent editorial tone, and integrity in product evaluation. Readers quickly detect when content is monetization-first, especially in a niche where financial decisions have long-term consequences.

Disclose affiliate relationships clearly, but also frame product mentions around real use cases or comparative advantages. Never recommend tools solely for commissions—review based on features that matter to the reader. Long-term trust enables sustainable traffic and compounding affiliate revenue, far beyond what aggressive link placement could ever achieve.

Common Mistakes When Monetizing Finance Blogs With Affiliate Links

One of the most common mistakes is assuming that affiliate revenue scales linearly with content volume. Publishing dozens of low-intent listicles rarely converts. Another error is ignoring technical SEO, which leads to buried content that never ranks. Others mistakenly promote every available program instead of curating for fit.

Failure to differentiate between evergreen and transient content also hampers strategy. For instance, featuring time-limited offers on top-ranking evergreen pages results in outdated links and decreased trust. Inadequate link tracking further compounds these issues by obscuring which placements are driving actual results.

Email Marketing Strategies For Affiliate-Driven Finance Blogs

Email marketing for affiliate monetization in finance works when it’s treated as an extension of user journey—not as a broadcast tool for dumping affiliate links. The key is to use segmentation to deliver precise content based on behavioral triggers, such as pages visited, tools downloaded, or quiz results completed. Readers interested in retirement planning should receive different content than those exploring crypto wallets.

Drip sequences tailored to intent stages are essential. For instance, someone opting into a budgeting worksheet might receive a sequence introducing deeper financial tools, culminating in affiliate offers with contextual relevance. Integrating affiliate links in educational series—not sales-heavy pitches—preserves trust while enabling conversion. Plain-text emails with conversational tones and CTA buttons tend to outperform HTML-heavy formats for financial niches.

Tools And Plugins To Help Monetize A Finance Blog With Affiliates

Several tools and plugins support finance blog monetization tips by optimizing link management, performance tracking, and content formatting. Affiliate link cloakers like ThirstyAffiliates or Pretty Links allow branded, manageable links that increase CTR and reduce broken redirects. Finance bloggers dealing with multiple programs benefit from dashboards that centralize link performance and earnings data.

Plugins such as AAWP or Lasso help dynamically insert affiliate boxes, compare offers, or show availability changes without manual edits. For SEO-technical users, custom schema generators can ensure product reviews include review markup, increasing SERP click-throughs. Tracking tools like Google Tag Manager enable event-based conversions, helping bloggers distinguish between clicks and actual qualified leads—crucial in a high-barrier niche like finance.

Creating Content Funnels For Affiliate Monetization In Finance

Financial blog content funnels must be designed backwards: start from the affiliate action you want and build content layers that logically lead there. A top-of-funnel post could explain how budgeting apps help freelancers organize income. The next layer might compare three tools in detail. The final content piece is a review or tutorial with deep financial affiliate links.

Each step in this funnel builds authority, solves a more specific problem, and creates psychological readiness for action. The structure should allow readers to progress from curiosity to decision naturally, without manipulation or forced urgency. Internal links, exit-intent popups, or newsletter lead magnets help retain and nurture users across multiple sessions—especially in high-research cycles like banking or investment platforms.

How To Optimize CTAs In Finance Articles With Affiliate Goals

Optimizing CTAs for finance blogs is about anticipating user hesitation and resolving it directly. A strong call to action finance content doesn’t shout; it guides. Instead of “Click here to get the best rates,” a more effective CTA might be: “Compare fee-free savings accounts that won’t penalize early withdrawals.” This frames the link as a service rather than a pitch.

Button placement, color contrast, and inline text framing also affect conversion. CTAs directly under comparison tables or after solving a problem in-text tend to outperform sidebars. On mobile, sticky footer CTAs with short microcopy perform best. Always A/B test wording, especially in regulated environments where wording must be accurate, not suggestive.

Monetization Strategies For Evergreen Vs Trend-Based Finance Topics

Evergreen and trend-based finance topics demand different monetization architectures. Evergreen content—such as tax strategies or compound interest guides—works well with timeless affiliate products like accounting software or long-term investment platforms. These pieces generate affiliate income from personal finance blogs over months or years and justify deep SEO investment.

Trend-based topics like fintech launches, crypto updates, or inflation-related guides can drive quick traffic surges but require real-time link management and frequent content refreshing. These are ideal for promoting limited-time affiliate offers or testing new partner programs. The monetization strategy here is speed-to-market, not depth. Mixing both content types allows for cash-flow stability and experimentation.

How To Stay Compliant With Financial Disclosures

Compliant finance blog affiliate marketing requires transparent disclosures that meet both legal requirements and reader expectations. Simply adding a footer disclaimer is not sufficient. Disclosures must appear before the affiliate link, in visible text, and be written in plain language. Phrases like “We may earn a commission if you click links on this page” fulfill the FTC’s basic standards.

Some affiliate programs impose their own wording or placement rules—especially those dealing with financial instruments like loans or credit products. Avoid embedding links in misleading anchor texts or implying guaranteed results. Always review the partner’s compliance documentation and include “no guarantee of outcome” language in reviews or recommendations. Legal pages should be linked from all content and include contact information for inquiries.

❓How Do I Start Monetizing My Finance Blog With Affiliate Marketing?

Start by choosing high-quality, relevant financial affiliate programs. Build content around user intent and strategically insert links with clear calls to action. Focus on alignment between what users search for and the affiliate products you introduce.

❓What Type Of Finance Blog Content Converts Best With Affiliate Links?

Product comparisons, how-to guides, and financial tool reviews generally perform well for affiliate monetization. These formats let users evaluate options without feeling sold to, increasing trust and conversion rates.

❓Can I Monetize A Small Finance Blog With Affiliate Links?

Yes. Even small blogs can earn affiliate income if the content is highly targeted and SEO-optimized. Niche authority and precise user targeting often outperform scale in finance affiliate strategies.

❓Do I Need To Disclose Affiliate Links On My Finance Blog?

Yes. Disclosures are required for legal and trust reasons, especially in finance where transparency is crucial. Use plain language and place disclosures near the first instance of affiliate links.

❓How Do I Track Affiliate Link Performance On My Finance Blog?

Use UTM parameters, affiliate dashboards, and link tracking tools to measure clicks, conversions, and earnings. Integrating with Google Analytics or using custom scripts allows deeper funnel analysis and attribution modeling.