There’s a reason most finance blogs don’t make money—despite ranking. And it’s not just about keywords. It’s about trust gaps, cognitive friction, and failing to meet the psychological bar that finance content marketing quietly demands. Writing about money isn’t the same as writing about gear or travel. In this space, the stakes are higher, and the margin for error is zero.

So, how do you write finance content that converts? You do it by aligning trust with transactional depth—through intentional structure, informed positioning, and respect for the intelligence of your reader. Let’s get into it.

What Makes Finance Content Unique Compared To Other Niches?

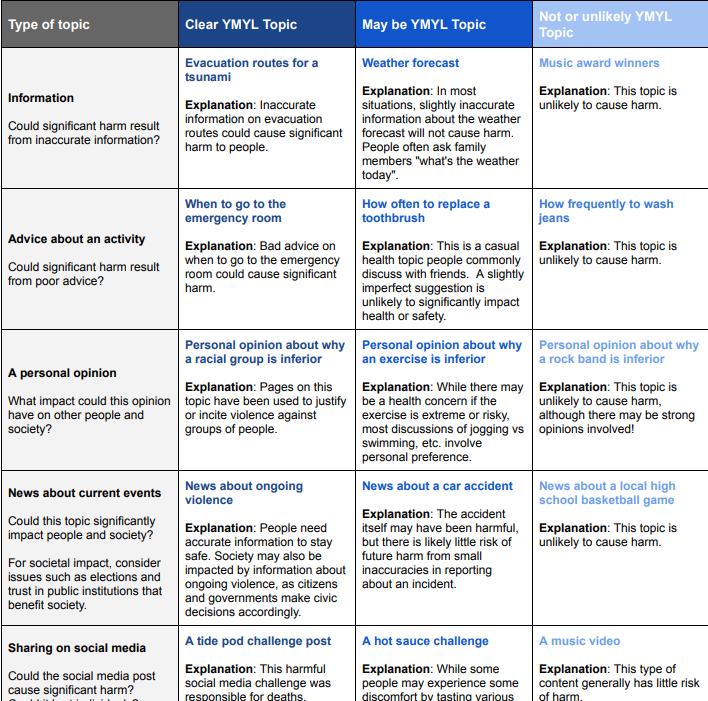

Finance content is unique because it exists within a high-regulation, high-skepticism niche where information directly influences personal wealth decisions. This puts it squarely within Google’s YMYL (Your Money or Your Life) guidelines, which raises the barrier to both trust and rankability.

In other content categories, conversion can often be driven by clever copy or surface-level benefits. But writing for YMYL niches requires layered, well-researched, and experience-backed information. The audience isn’t just scanning for features—they’re evaluating risks. As a result, finance articles that convert must be transparent, legally sound, and psychologically calibrated to reduce friction around fear, skepticism, and doubt.

The way information is presented also diverges sharply from casual niches. Tone and format matter in high-converting finance content, but so does precision. Over-simplifying complex topics leads to mistrust. Over-complicating alienates readers. Walking that line requires not only knowledge of the topic but of finance content SEO, behavioral psychology, and legal compliance.

What further sets this niche apart is latency of conversion. Finance readers don’t always click immediately—they bookmark, they return. That means content that converts finance must be sticky. Long-form structures, return visit CTAs, and deferred monetization points aren’t optional—they’re baked into the finance content funnel.

Why Conversion Optimization Is Crucial In Finance Content

Conversion optimization is crucial in finance content because traffic without trust-based action produces no return. Unlike ecommerce or SaaS, finance readers may read 2,000+ words and still not act—unless each layer of your content strategically reduces conversion resistance.

In finance, a conversion is rarely impulse-driven. You’re asking the user to open a brokerage account, apply for a credit card, or invest in a savings plan. These actions involve risk, regulation, and sometimes irreversible consequences. Your job isn’t just to inform; it’s to guide decisions with zero coercion and full clarity. That’s why finance copywriting tips emphasize clarity over persuasion, and flow over hype.

At a structural level, optimized finance content doesn’t rely on traditional CTA buttons alone. Instead, it creates micro-moments of validation throughout—such as citing updated APR data, embedding contextual FAQs, or noting real use-case examples within affiliate finance articles. These aren’t flashy tactics, but conversion trust-builders.

Finally, monetization must be seamlessly baked into the structure. A common failure point in finance affiliate content is late-stage linking with no prior value scaffold. Conversions don’t occur because links are inserted—they occur because the context of the link was methodically earned. That’s the distinction between affiliate link placement finance articles that convert, and those that don’t.

How To Structure Finance Content For High Engagement

To write finance content that converts, structure must follow user psychology—not just keyword flow. The average user in this niche seeks one of three things: clarity on options, guidance through a process, or validation for a decision already made.

Your structure needs to anticipate these motives early and reflect them visually and cognitively.

When building structure for finance articles that convert, consider:

- Start with a problem-based hook and follow with a solution-driven narrative.

- Use H2s to mirror user questions searched in Google (e.g., “Is this credit card worth it?”).

- Insert inline definitions for technical terms (e.g., APR, APY) to reduce reader friction.

- Keep paragraphs short and scan-friendly without watering down substance.

An effective format for how to write finance blog posts begins with problem anchoring—showing the reader you understand their friction point. From there, introduce variables (choices, steps, tools) and outline them without bias. Add depth with visual elements like charts or side-by-side comparisons—but don’t let them carry the narrative.

For example, in a post comparing savings accounts, your structure shouldn’t start with “What Is A Savings Account?” unless you’re targeting beginners. Instead, start with rate variation, liquidity features, or compound interest implications—what an experienced reader actually cares about. This demonstrates awareness of content strategy finance niche maturity levels.

Equally important is your internal linking logic. Optimizing finance pages for engagement means connecting content along lateral intent, not just vertical hierarchy. A post about credit card rewards should link to tax implications of cash-back, not just other credit card reviews. That’s how you create meaningful on-site dwell time and user loops.

Understanding Your Target Audience In The Financial Niche

Understanding your target audience in the financial niche means knowing both their financial goals and their decision-making limitations. Unlike other verticals, financial readers often arrive with cognitive overload, skepticism from past experiences, and risk aversion tied to real money outcomes.

This means audience segmentation must go beyond “beginner” or “expert.” Within each vertical—investing, budgeting, lending—you must parse for urgency levels, liquidity access, and regulatory exposure. A millennial seeking Roth IRA advice doesn’t convert on the same signals as a retiree comparing annuity options. Yet both read finance content marketing articles.

Behavioral cues are often hidden in query structures. Long-tail queries with legal qualifiers (“is it safe,” “tax implications,” “can I lose money”) reflect high-friction readers. Your content must answer with legal transparency, and more importantly, explain risk in plain English. This is essential in writing for YMYL niches, where fear often blocks conversion.

The key here is empathy without dumbing down. Use financial terminology when required—but only if it’s followed by an immediately practical definition or implication. Assume intelligence, not fluency. That distinction is what makes finance blog best practices so context-dependent, and why generalized tone models don’t work in this niche.

The Role Of Topical Authority In Finance SEO

Topical authority refers to a website’s perceived expertise and depth on a specific subject, based on the quality and interconnectedness of its content.

Topical authority in finance SEO determines whether your content will rank for commercial-intent queries over long periods. Google prioritizes domain-level trust in financial verticals more aggressively than in almost any other sector.

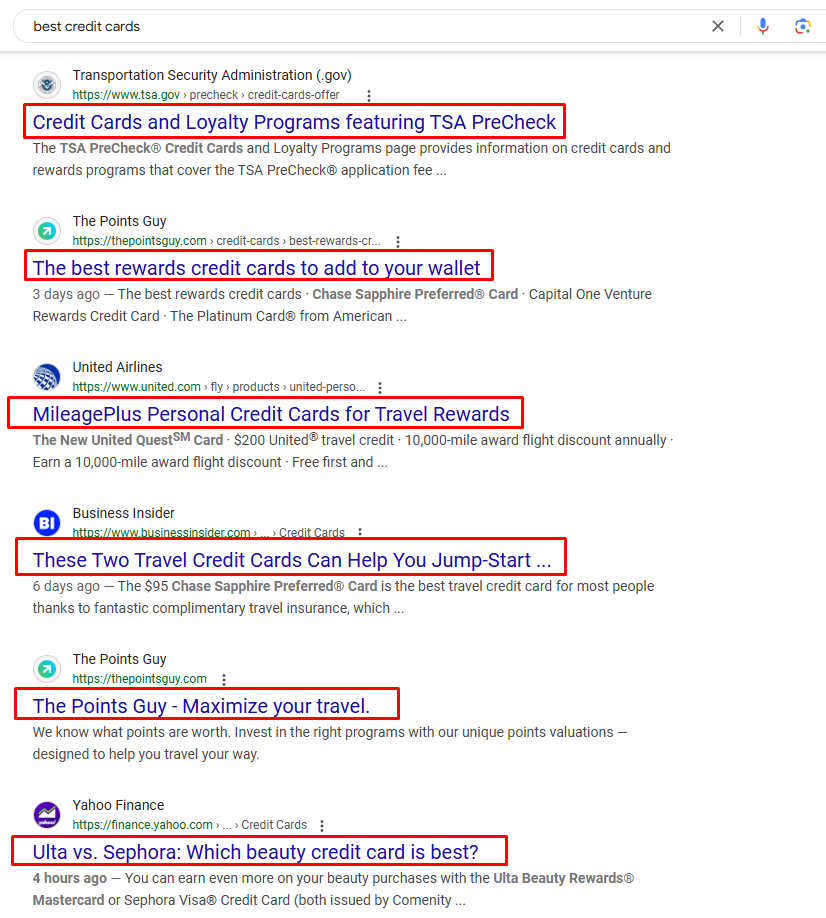

This means publishing a high-ranking article on “best credit cards” doesn’t just require keyword targeting—it requires a history of depth on adjacent topics. If your site lacks strong articles on credit utilization, interest mechanics, and application workflows, your card review content will remain buried. That’s why building topical clusters is non-negotiable in finance content SEO.

Depth over breadth is the core rule. It’s not enough to post five articles about personal loans. You need content on debt-to-income ratios, loan amortization schedules, soft vs hard credit checks, and regulatory differences by state. Without these, your site lacks semantic authority.

Beyond ranking, topical authority also feeds into trust with users. When someone lands on your content and sees related, high-depth articles linked contextually, it validates your role as a guide—not just a traffic trap. That builds dwell time, return visits, and ultimately, finance content conversion.

Writing Headlines That Drive CTR In Finance Articles

Headlines drive CTR in finance articles by signaling specificity, safety, and relevance—not clickbait. In this niche, vague or overpromised headlines tend to repel users rather than attract them.

The most effective headlines use numbers, context, and consequence. For example: “5 Tax-Free Investments To Shield $10K In 2025” performs better than “Best Investments for Next Year.” The former speaks directly to use-case, regulation, and gain—all in a compact phrase. This is crucial in finance copywriting tips, especially when targeting savvy users.

Another overlooked tactic is using intent qualifiers within the headline: “Low-Risk,” “Beginner-Friendly,” “For Freelancers.” These pre-filter your audience, lowering bounce rates and ensuring alignment between query and content. In finance content examples, this strategy is often missing in favor of over-optimized keywords.

Finally, test headline variants in email or PPC formats before publishing them on blog posts. What wins in paid often reveals what the market actually wants. You’re not just trying to rank—you’re trying to get clicked. That distinction is what defines finance articles that convert.

How To Incorporate Affiliate Links Naturally In Finance Content

To incorporate affiliate links naturally in finance content, you need to anchor them to decision-making moments—not just product mentions. Inserting a link where the user has no intent to act will suppress trust and damage the page’s integrity.

The most effective placements follow value. Walk the user through a scenario—such as choosing between two mortgage types—and only then link to a rate comparison tool or application portal. This ensures the link arrives after credibility has been built, and intent confirmed. That’s how affiliate finance articles maintain both user trust and monetization flow.

It’s also important to label affiliate links transparently. Cloaking links or hiding them under vague anchor text (“click here”) raises suspicion in this niche. Instead, use specific, accurate anchors: “Check current APRs from [Provider]” or “View no-penalty CDs here.” This aligns with finance blog best practices and supports both SEO and compliance.

Use link frequency sparingly. One well-placed, high-converting affiliate link outperforms five scattered, ignored ones. Track clicks and adjust based on scroll behavior, not just word count. This makes affiliate link placement finance content feel human, not monetized by default.

SEO Best Practices For Monetized Finance Content

The best SEO practices for monetized finance content focus on semantic depth, link velocity consistency, and structured data clarity—not just keyword stuffing. In finance content SEO, on-page optimization is not merely a technical checklist; it’s an ongoing calibration of trust signals, topic coverage, and monetization transparency.

Start by addressing E-E-A-T signals inline, not just in author bios. Embedding expert commentary, citing regulatory sources (like the CFPB or IRS), and providing original data analysis contributes directly to E-E-A-T in finance SEO. These don’t just satisfy algorithms—they reassure human readers that your content is well-informed and safe to act upon.

Next, use schema markup—a form of structured data that helps search engines understand and display your content more accurately—not only for articles, but also for FAQs, reviews, and pros/cons sections where applicable. For example, a comparison post on high-yield savings accounts should include Product and AggregateRating schemas if affiliate links are embedded. This enhances SERP visibility and aligns with Google’s structured monetization expectations.

Internal link consistency across clusters—groups of related content—plays a larger role in finance content SEO than in general niches. This structure tells search engines that your site has topical depth.

Here’s how to manage clusters effectively:

- Always tie affiliate pages back to non-commercial educational content.

- Identify 3–5 core financial themes (e.g., credit building, budgeting, investing).

- For each, create 1 long-form pillar guide and 5–8 support articles.

- Link them consistently using contextual anchor text (not forced link blocks).

If you’re building out a content strategy finance niche, every monetized article must tie back to high-authority educational pieces. This satisfies crawler logic and builds thematic authority. Random monetized pages with no educational foundation often get suppressed algorithmically.

Using Trust Signals To Boost Conversions In Finance Pages

Trust signals boost conversion in finance pages by reducing perceived risk at the exact moment a user considers action. This is critical because, in financial topics, conversion friction is rarely caused by lack of information—it’s caused by lack of confidence.

The most effective trust signals are those integrated naturally within the content itself. Inline definitions of financial terms reduce ambiguity. Mentioning FDIC insurance or SSL encryption in banking-related posts reassures users even before they scroll to a CTA. Testimonials or quotes from professionals in-context are more believable than isolated reviews.

Visual cues matter, too. Use subtle but intentional formatting to call attention to updated information—like timestamped APR ranges or dynamically pulled rate data. These reinforce that your optimizing finance pages strategy includes up-to-date accuracy, not just static content. It’s a form of trust-by-freshness.

You should also avoid overuse of generic badges or third-party widgets unless they directly contribute to decision-making. In finance content conversion, excessive visual “proof” can feel promotional or manipulative. Minimalism with purpose always wins over decoration without function. If a badge is present, explain its origin or verification.

Conversion Funnel Strategy For Finance Content Marketing

A conversion funnel strategy for finance content marketing must map informational content to transactional intent across multiple sessions—not just single-click behavior. Users in this niche often require repeated exposure, reassurance, and deferred action triggers.

Begin with awareness-phase content that solves clear, low-commitment problems—like “how to automate savings” or “credit score myths.” These posts should not aggressively push products but should subtly introduce categories and options. This is where you build cookie pools or collect emails if applicable.

Mid-funnel content should focus on comparisons, calculators, and practical how-tos. Here’s where finance content funnel tactics shine. Articles like “Roth vs. Traditional IRA for Freelancers” or “Best Student Checking Accounts” guide users toward active decision points. It’s within these pages that affiliate link placement finance elements begin to emerge—always context-first.

Bottom-funnel pages are your product reviews, application guides, and “best of” lists. These must be structured, visually skimmable, and free of fluff. Every paragraph must justify its presence. Ideally, these are linked from multiple entry points to create circular internal logic and maximize exposure to high-intent pages. That’s how you build content that converts finance consistently.

FAQ

What type of finance content converts best?

Lists, comparisons, reviews, and how-tos with clear CTAs perform best. These formats allow users to digest information quickly, compare options, and take confident next steps—all of which align with decision-making in financial contexts. To improve engagement, ensure the call-to-action is embedded naturally and backed by educational framing.

How long should finance content be to convert well?

Ideally 1,500–2,500 words with a clear structure and monetization points. This range allows enough depth to satisfy YMYL requirements, while maintaining focus and reader interest. Break up content with subheadings, visuals, and inline trust signals to improve dwell time and action rates.

Should I include disclaimers in finance affiliate content?

Yes, always disclose financial relationships to build trust and comply with regulations. Lack of transparency can damage credibility and put your platform at legal risk. A clear affiliate disclosure should appear both at the top and within monetized sections, especially in finance affiliate content.

How do I balance helpful content with affiliate monetization?

Focus on value-first writing and insert affiliate links only where relevant. Don’t rush to monetize every paragraph. Instead, deliver meaningful insights, and only place links after you’ve established informational authority and aligned them with clear user intent.

Is finance content harder to rank and convert?

Yes, due to YMYL constraints, trust and expertise matter more than other niches. Finance requires deeper editorial review, stronger topical authority, and ongoing updates to retain rankings. Conversion also demands more psychological reassurance and ethical clarity.