What would happen if you could monetize one of the most recognized fintech brands without selling a single paid product? That’s the quiet promise behind Credit Karma’s affiliate program—a free-to-use service that still pays affiliates. But what looks straightforward from a distance often carries nuances that only seasoned finance affiliates recognize. So, is the Credit Karma affiliate program truly effective for driving sustainable affiliate revenue, or is it just another low-commission trap masked by brand recognition?

📌 Quick Details: Credit Karma Affiliate Program at a Glance

| Feature | Details |

|---|---|

| Commission per Signup | $6–$7 (Impact: $6, Awin: $7) |

| Reactivation Bonus | $4 for dormant users (Awin only) |

| Special Payouts | $12 per mortgage submission (rare) |

| Cookie Duration | 30 Days |

| Affiliate Networks | Awin, Impact |

| Eligible Countries | Primarily U.S. based |

| Ideal Audience | Personal finance-focused, U.S. or Tier 1 traffic |

| Support Tools | Real-time dashboard, banners, links, widgets |

What Is the Credit Karma Affiliate Program?

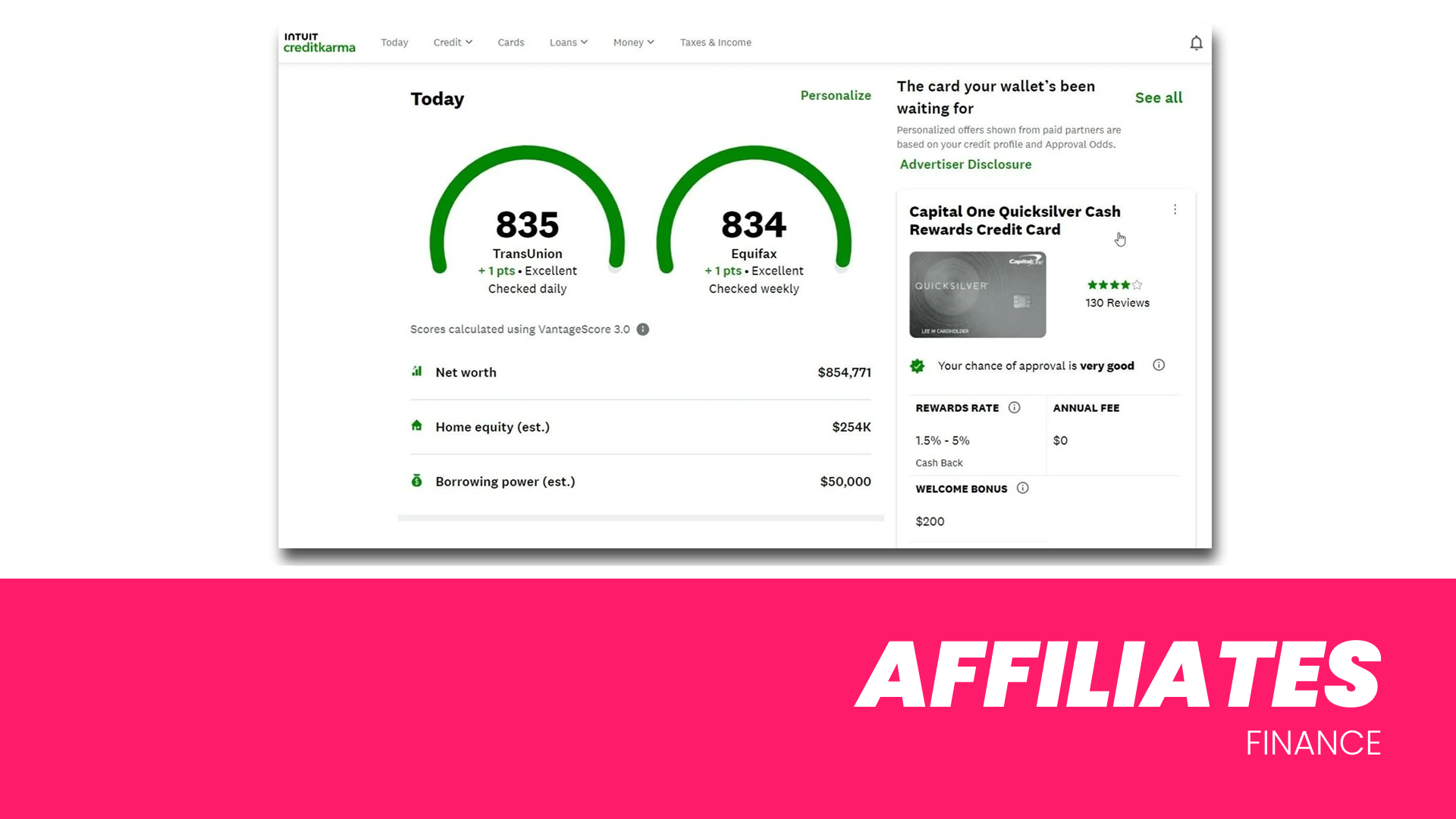

The Credit Karma affiliate program is a referral-based system where affiliates earn commissions by driving new users to sign up for Credit Karma’s suite of free financial tools. Unlike programs that rely on selling subscriptions or one-time purchases, Credit Karma hinges entirely on sign-ups to its no-cost services—credit monitoring, tax prep tools, and financial recommendations.

This model is particularly distinct in that affiliates are not promoting a revenue-generating product for the user. The value proposition lies solely in the trust and utility of the service, not in its price or exclusivity. This shifts the affiliate’s role from “salesperson” to “traffic curator”—focusing more on qualified clicks and less on persuasive conversions. For marketers in the personal finance space, that opens the door to broader content strategies. However, it also means that earning potential is capped unless high traffic volumes are maintained.

How Does the Commission Structure Work?

Credit Karma’s affiliate commissions are low in absolute value but strategically structured to maximize scalability. The program typically pays:

- $6–$7 per new user sign-up, depending on the affiliate network you choose.

- Awin pays the higher end at $7.

- Impact pays $6 but offers global reach.

- $4 for dormant user reactivation (Awin only): This applies when a previously inactive user—who hasn’t logged in for over a year—signs back up through your link.

- $12 for online mortgage submissions: This payout applies under very narrow conditions and is rarely accessible to affiliates with general traffic.

The commissions may appear modest at first glance. But for sites with high U.S. traffic volumes and relevant financial content, the program can be scaled effectively. Especially in content verticals that naturally align with Credit Karma’s features—such as articles on improving credit scores, disputing credit errors, or preparing taxes—conversion rates can remain surprisingly high.

Who Should Join the Credit Karma Affiliate Program?

The Credit Karma affiliate program is not for generalist bloggers or entry-level affiliates. It’s calibrated for content creators with established reach in finance or budgeting verticals—especially those who understand how to segment and qualify their traffic before the click even happens.

Here’s a more granular view of who fits:

- Personal finance bloggers with U.S.-focused content and an audience that actively seeks budgeting, credit score tips, or tax prep.

- Credit repair influencers whose followers are already exploring tools to improve credit health.

- Affiliate site owners monetizing finance-based comparison articles or tool roundups.

- YouTube channels focused on “how to fix your credit” or “free credit report” walkthroughs.

To succeed with Credit Karma, your traffic must do one thing very well: trust free tools enough to give up personal info in exchange. This is a particular behavioral conversion. Your audience doesn’t just need to be financially curious; they need to be ready to sign up for a tool and input real data.

What Makes the Program Unique Compared to Other Finance Affiliate Offers?

Credit Karma’s affiliate offer diverges from the norm in one important way—it monetizes intent rather than purchase. In most affiliate programs, your revenue is tied to a purchase decision. Here, the barrier is significantly lower. That sounds like a win, but there’s an underlying complexity: you don’t control monetization levers post-conversion.

Unlike programs that offer upsell opportunities or long LTV arcs (e.g., credit card programs with residual commissions), your earnings with Credit Karma are front-loaded and flat. There’s no residual upside, no percentage-of-sale escalators, and no product ladder to ascend.

Additionally, since the core offer is “free credit tools,” your content must do most of the heavy lifting. There’s no pricing angle to lean on, and no urgency driven by discount codes or limited-time trials. That forces a content-first affiliate approach, where your ability to rank, pre-qualify, and funnel users matters more than your persuasion tactics.

What Are the Affiliate Requirements and Approval Process?

Getting into the program isn’t automatic, and unlike low-barrier affiliate marketplaces, Credit Karma (via Awin or Impact) evaluates your traffic relevance closely. Here’s what you need to get approved:

- A finance-related website or platform with content specifically geared toward credit scores, financial planning, loans, or taxes.

- A demonstrated ability to drive quality traffic. Empty domains or generalist blogs often get denied.

- Compliance with Credit Karma’s promotional policies—no deceptive tactics, fake offers, or misleading claims.

- Preferably, U.S.-based or U.S.-relevant traffic. While Impact allows for more geographic flexibility, both networks heavily favor American audiences.

Approval turnaround times vary between the two platforms. Awin may take longer, but offers slightly higher payouts and the dormant-user reactivation bonus. Impact is more streamlined and suitable for international publishers but lacks some of the niche payout features.

What Tools and Tracking Support Are Provided?

Credit Karma provides a basic but sufficient affiliate infrastructure. This includes:

- Real-time performance dashboards through Awin or Impact. These show clicks, signups, commissions, and performance over time.

- Promo assets such as banners, referral links, and widgets. These are static and not particularly dynamic but work well enough for contextual embeds.

- Affiliate manager support through each network, though responses are typically limited to technical issues rather than campaign strategy.

The lack of dynamic landing pages or customizable campaigns may limit deeper segmentation. However, for high-volume affiliates focused on SEO or content-first approaches, this level of tooling is typically enough.

Where Does Credit Karma Fall Short?

Credit Karma’s program isn’t without its flaws—and they’re critical to understand before investing content cycles into promotion.

First, the commission rates are objectively low. Earning $6–$7 per signup doesn’t compare favorably to competitors that offer $30–$100 payouts, especially those with paid product funnels.

Second, there’s no upsell incentive. You earn once—at the signup moment. Credit Karma doesn’t extend revenue sharing into any post-signup user behavior. No product purchases, no account upgrades, no referral boosts.

Third, the product portfolio is narrow. You’re essentially promoting credit scores and tax tools—both useful, but not diverse. This can limit your ability to weave Credit Karma naturally into a wide range of finance content.

Fourth, the program is heavily geo-constrained. U.S. traffic is a must. While Impact allows for global signups, conversions from non-U.S. traffic are unlikely to succeed due to product incompatibility or onboarding friction.

What Is the Best Strategy to Monetize Credit Karma as an Affiliate?

The most effective strategy for Credit Karma is stacked monetization. That means:

- Embedding Credit Karma links into comparison content. Example: “Best Free Credit Monitoring Tools” or “How to Fix Your Credit Score Without Paying.”

- Pairing Credit Karma with higher-ticket affiliate offers. Example: a blog post about “Rebuilding Your Credit” could include Credit Karma and a secured credit card affiliate link.

- Email funnels that lead with a free offer (Credit Karma), then upsell into budgeting tools, debt consolidation services, or credit cards.

This layered approach allows Credit Karma to serve as the entry-point offer, warming users up before introducing higher-commission programs. Its free status removes friction, while its brand name improves CTR. But it should rarely be your only monetization tool.

Final Thoughts: Is the Credit Karma Affiliate Program Worth It?

The Credit Karma affiliate program is worth it if used surgically, not as a standalone strategy. It works best when it complements other financial affiliate programs and helps round out a funnel with a no-cost offer. You won’t build a six-figure affiliate income on Credit Karma alone—but it can significantly boost your total EPC (earnings per click) when used properly.

Its strength lies in brand recognition and conversion ease, not in payout size or funnel depth. That makes it ideal for SEO-driven publishers, finance bloggers, and creators with content formats built around free financial tools. If your audience is actively trying to improve their financial situation and trusts free tools, Credit Karma becomes an effective piece of your affiliate stack.

But if you’re looking for high-ticket commissions, complex buyer journeys, or deep product ecosystems, Credit Karma will likely fall short. As with most affiliate tools, it’s not about whether it pays—it’s about where it fits in your broader strategy.